- Markov Decisions Problems; Bellman’s Equation; Two examples

A Markov Decision Process is a Dynamic Program where the state evolves in a random/Markovian way.

As in the post on Dynamic Programming, we consider discrete times , states

, actions

and rewards

. However, the plant equation and definition of a policy are slightly different.

Def 1 [Plant Equation] The state evolves according to functions . Here

where are IIDRVs uniform on

. This is called the Plant Equation. As noted in the equivalence above, we will often suppress dependence on

. Also, we will use the notation

![\mathbb{E}_{x_t a_t} [G({x}_{t+1})] = \mathbb{E} [G(f_t(x_t,a_t))]](https://appliedprobability.blog/wp-content/uploads/2017/04/f79a005d563ea81e4e2e3494393fe07b.png?w=840)

Def 2 [Policy] A policy choses an action

at each time

as a function of past states

and past actions

. We let

be the set of policies.

A policy, a plant equation, and the resulting sequence of states and rewards describe a Markov Decision Process. Objective is to find a process that optimizes the following objective.

Def 3 [Markov Decision Problem] Given initial state , a Markov Decision Problem is the following optimization

![\begin{aligned} W(x_0) =& \text{Maximize} \quad R_T(x_0,\Pi):= \mathbb{E} \left[ \sum_{t=0}^{T-1} r_t(x_t,\pi_t) + r_T(x_T)\right]\\ &\text{over} \qquad\qquad \Pi \in \mathcal{P}.\notag \end{aligned}](https://appliedprobability.blog/wp-content/uploads/2017/04/d09aca4f94bf7fdb098f06fcdf9f65ab.png?w=840)

Further, let (Resp.

) be the objective (Resp. optimal objective) for when the summation is started from time

and state

, rather than

and

.

Ex 1 [the Bellman Equation]Setting for

![\tag{Bell eq.} W_t(x_t) = \sup_{a_t\in\mathcal{A}_t} \left\{ r_t(x_t,a_t) + \mathbb{E}_{x_t,a_t} \left[ W_{t+1}(x_{t+1})\right] \right\}.](https://appliedprobability.blog/wp-content/uploads/2017/04/470d6081e28ce5bf84a622f9c01cf098.png?w=840)

The above equation is Bellman’s equation for a Markov Decision Process.

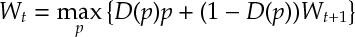

Ex 2 You need to sell a car. At every time , you set a price

and a customer then views the car. The probability that the customer buys a car at price

is

. If the car isn’t sold be time

then it is sold for fixed price

,

. Maximize the reward from selling the car and find the recursion for the optimal reward when

.

Ex 3 You own a call option with strike price . Here you can buy a share at price

making profit

where

is the price of the share at time

. The share must be exercised by time

. The price of stock

satisfies

for

for IIDRV with finite expectation. Show that there exists a decreasing sequence

such that it is optimal to exercise whenever

occurs.

Answers

Ans 1 , the set policies that can be implemented from time

to

, is the product actions at time

and the set of policies from time

onward. That is

.

![\begin{aligned} W_t(x_t) &= \sup_{\Pi_t \in \mathcal{P}_t} \mathbb{E}_{x_t \pi_t} \left[ \sum_{t=0}^{T-1} r_t(x_t,\pi_t) + r_T(x_T)\right]\\ &= \sup_{\pi_t } \sup_{\Pi \in \mathcal{P}_{t+1}} \Bigg\{ r_t(x_t,\pi_t) + \mathbb{E}_{x_t \pi_t} \Bigg[\mathbb{E}_{x_{t+1} \pi_{t+1}}\Bigg[\sum_{\tau=t+1}^{T-1} r_{\tau}(x_\tau,\pi_\tau) + r_T(x_T)\Bigg]\Bigg]\Bigg\}\\ &= \sup_{a\in\mathcal{A} } \Bigg\{ r_t(x_t,a) + \mathbb{E}_{x_t\, a} \Bigg[ \underbrace{\sup_{\Pi \in \mathcal{P}_{t+1}}\mathbb{E}_{x_{t+1} \pi_{t+1}}\Bigg[\sum_{\tau=t+1}^{T-1} r_{\tau}(x_\tau,\pi_\tau) + r_T(x_T)\Bigg]}_{=W_{t+1}(x_{t+1})}\Bigg]\Bigg\} \end{aligned}](https://appliedprobability.blog/wp-content/uploads/2017/04/b6bc51e51b27672878d0bf8cd459644e.png?w=840)

2nd equality uses structure of , takes the

term out and then takes conditional expectations. 3rd equality takes the supremum over

, which does not depend on

, inside the expectation and notes the supremum over

is optimized at a fixed action

(i.e. the past information did not help us.)

Ans 2 The optimal reward from time onward (assuming you still have the car) satisfies:

If then

. (Note the relation is monotone and

converges to fixed point if

.)

Ans 3 Taking the and subtracting gives

![\label{MDP:BellCall} W_t(x)-x = \max\left\{ -p, \mathbb{E}\left[W_{t+1}(x+\epsilon_t) -x \right] \right\}](https://appliedprobability.blog/wp-content/uploads/2017/04/879b46300df5bc0eb2520846c7bcb987.png?w=840)

1) , because all policies implemented from time

are subset of policies from time

.

2) is decreasing and cts in

because

is and, since expectation and maximum preserve these properties, so is

by induction on .

Thus the point where

must decrease.