We consider a specific diffusion control problem. We focus on setting where there is one risky asset and one riskless asset, though we will see that much of the analysis passes over to multiple assets.

Def. [The Merton Problem – Plant Equation] In the Merton problem you wish to optimise your long run consumption. You may invest your wealth in a bank account receiving riskless interest , or in a risky asset with value

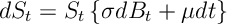

obeying the following SDE

where each is an independent standard Brownian motion.

Wealth obeys the SDE

You can control your rate of consumption at time

and

the number of stocks the risky asset at time

. Also, we define

to be the wealth in the risky asset at time

.

Def. [The Merton Problem – Objective] Given the above plant equation, , the objective is to maximize the long-term utility of consumption

![\begin{aligned} V(w_0) = \max_{(n_t,c_t)_{t\geq 0}\mathcal P ( w_0)} \mathbb{E}\left[\int_0^\infty e^{-\rho t} u(c_t) dt\right]. \end{aligned}](https://appliedprobability.blog/wp-content/uploads/2018/03/6b20a69d79c794f4a0c0fe370038f4e2.png?w=840)

Here is a positive constant and

is a concave increasing utility function. The set

is the set of policies given initial wealth

. Further, let

be the optimal objective with the integral starting for time

with

.

Let’s write the wealth respect to integrals in and

:

Ex 1. Show that

![dW_t = e^{-\rho t} \partial _w V(W_t) \left[ r \left(W_t - n_t\cdot S_t\right) dt + n_t \cdot dS_t - c_t dt \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/26855fe858c4fa92a34710a9dbfe19a1.png?w=840)

Ans 1.

Ex 2. Show that

Ans 2. Notice if we shift time by , a factor

comes out,

![V(w,\tau) = \max_{(n_t,c_t)_{t\geq \tau}} \mathbb{E}\left[\int_\tau^\infty e^{-\rho t} u(c_t) dt\right] = \max_{(n_t,c_t)_{t\geq 0}} \mathbb{E}\left[\int_0^\infty e^{-\rho (t+\tau)} u(c_t) dt\right] = e^{-\rho \tau}V(w)\, .](https://appliedprobability.blog/wp-content/uploads/2018/03/d6f1ad9e87776f67e0d219b880895809.png?w=840)

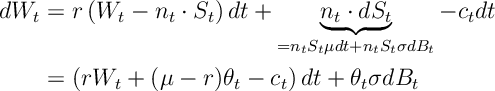

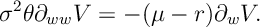

Ex 3. Show that the HJB equation for the Merton Problem can be written as

or, alternatively, as

or, alternatively, as

Ans 3. Recall that informally the HJB equation is

Notice that if we apply Ito’s formula to we get that

![\begin{aligned} d V ( W_t ) & = \partial _w V(W_t ) dW_t +\partial_t V(W_t ) dt + \frac{1}{2} \partial_{ww} V(W_t) d [W]_t \\ & = \partial _w V(W_t) \left[ r \left(W_t - n_t\cdot S_t\right) dt + n_t \cdot dS_t - c_t dt \right] \\ & + \partial_t V(W_t) dt + \frac{\theta^2\sigma^2}{2} \partial_{ww} V(W_t) dt\end{aligned}](https://appliedprobability.blog/wp-content/uploads/2018/03/e999a2a048489c3cbc2b02dc0baeefd5.png?w=840)

Applying this to the above term gives as required

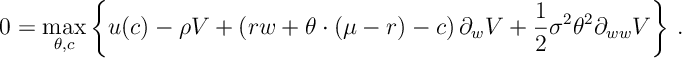

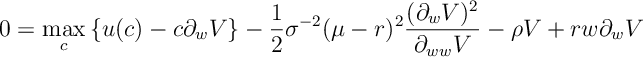

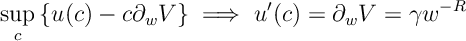

Ex 4. [Continued] Optimizing the HJB over , show that

Ans 4. Differentiating the HJB equation in [[cDP:MertonHJB]] wrt gives

Now rearrange for .

Ex 5. [Continued] Given , show that the HJB equation becomes

Ans 5. Substituting gives

Merton for CRRA Utility

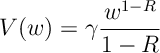

We focus on the case of CRRA utility, that is:

for (Recall the discussion on utility functions, Section [Util]). Thus we wish to solve for

![\begin{aligned} V(w_0) = \max_{(n_t,c_t)_{t\geq 0}} \mathbb{E}\left[\int_0^\infty e^{-\rho t} \frac{c_t^{1-R}}{1-R} dt\right]. \end{aligned}](https://appliedprobability.blog/wp-content/uploads/2018/03/a36c7ec5b1e44cee98a6564d858073e6.png?w=840)

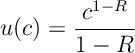

Ex 6. Show that

Ans 6. Here we note that having a policy for initial wealth is the same as having a policy of wealth

and then multiplying each amount invested by

:

![\begin{aligned} V(\lambda w) & = \max_{(n_t,c_t)_{t\geq 0}\in \mathcal P (\lambda w_0)} \mathbb{E}\left[ \int_0^\infty e^{-\rho t} \frac{c_t^{1-R}}{1-R} dt \right] \\ & = \max_{(n_t,c_t)_{t\geq 0}\in \mathcal P ( w_0)} \mathbb{E}\left[ \int_0^\infty e^{-\rho t} \frac{ (\lambda c_t)^{1-R}}{1-R} dt \right] = \lambda^{1-R} V(w). \end{aligned}](https://appliedprobability.blog/wp-content/uploads/2018/03/d000dda13de0bd7cd82ecb28dd7ff84a.png?w=840)

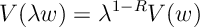

Ex 7. Show that

for some position constant .

Ans 7. In [6], let and

.

Ex 8. Show that

Ans 8. Trival.

Ex 9. Show that if we define

then for a CARA utility

Ans 9. Differentiating gives now rearrange and substitute.

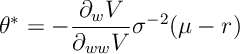

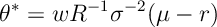

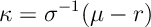

Ex 10. Show that, when optimizing over , the HJB equation is optimized by

Ans 10.

which since , gives the required formed.

Ex 11. [Merton:CARA4] Show that

Ex 12. [Continued]Show that

Ans 12. By [8] and [10]

Ex 13. Given the optimal choices of and

, Show that the HJB equation to be satisfied it must be that

where

To summarize: we notice we have show that the parameters given by

in exercises [4, 10, 13] give a solution to the HJB equation for the Merton problem. (Although we have not yet proven them to be optimal.)

We now give rigourous argument for the optimality of parameters ,

and

for the Merton problem with CRRA utility. (This section can be skipped if preferred.)

Ex 14. Show that

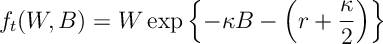

![\mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c_t) dt \right] - \mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c^*_t) dt \right] \leq \mathbb E \left[ \int_{0}^{\infty} \left( c_t-c^*_t \right) \zeta_t dt \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/fc995bf5db9ed74e863eccb608651d7a.png?w=840) where

where

(Hint: is concave.)

Ans 14. Since is concave we have that

. Thus

![\begin{aligned} \mathbb E \left[ \int_0^\infty e^{-\rho t} u(c_t) dt \right] & \leq \mathbb E \left[ \int_0^\infty e^{-\rho t} \left\{ u(c^*_t) + (c_t - c^*_t ) u'(c^*_t) \right\} dt \right]\\ & = \mathbb E \left[ \int_0^\infty e^{-\rho t} u(c^*_t) dt \right] + \mathbb E \left[ \int_{0}^{\infty} \left( c_t-c^*_t \right) \zeta_t dt \right]\end{aligned}](https://appliedprobability.blog/wp-content/uploads/2018/03/83b17be9b914d35a2ba5d9a4429bda51.png?w=840)

Ex 15. Verify that

is a positive local martingale. [Hint: apply Ito’s formula to

]

Ex 16. [Continued] Show that

![w_0 \geq \mathbb{E} \left[ \int_{0}^{\infty} \zeta_s c_s ds \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/cd2dd58307db4dadeb77e7825cd091ab.png?w=840)

[Hint: Doob’s Martingale Convergence Theorem.]

Ans 16. Recall from stochastic integration theory that every positive local martingale is a supermartingale. Doob’s Martingale Convergence Theorem applied to [15] gives

![w_0 = Y_0 \geq \mathbb E Y_{\infty} = \mathbb E \left[ \int_0^\infty \zeta_s c_s ds \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/9a480cf60586b56dc6e54dc7cf080267.png?w=840)

Ex 17. [Continued] By direct calculation show that

![w_0 = \mathbb{E} \left[ \int_{0}^{\infty} \zeta_s c_s^* ds \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/0300913f97d085d609affc10d148fa4e.png?w=840)

[Hint: apply Fubini’s Theorem and note that

![\mathbb E \left[ e^{\alpha B_t - \frac{\alpha^2}{2} t} \right]=1](https://appliedprobability.blog/wp-content/uploads/2018/03/901dfa0ca33165ea7c3748a93fa639dc.png?w=840)

]

Ex 18. Now show that

![\mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c_t) dt \right] \leq \mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c^*_t) dt \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/24785b8a02242a615ab282d8b492b4e2.png?w=840)

Ans 18. Combining [16] and [17], we see that ![\mathbb E \left[ \int_{0}^{\infty} \left( c_t-c^*_t \right) \zeta_t dt \right] \leq 0\, .](https://appliedprobability.blog/wp-content/uploads/2018/03/07e2524f7afb207cf810598d7f4597b7.png?w=840)

Applying this to [14] we see that

![\mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c_t) dt \right] \leq \mathbb{E} \left[ \int_{0}^{\infty} e^{-\rho t } u(c^*_t) dt \right]](https://appliedprobability.blog/wp-content/uploads/2018/03/24785b8a02242a615ab282d8b492b4e2.png?w=840)

as required. Thus is optimal.

The last exercise shows that the portfolio is optimal for the Merton problem with CRRA utility.

One thought on “Merton Portfolio Optimization”